Writing a business plan isn't something to be taken lightly. A survey by the University of Oregon's

Department of Economics found that companies that complete a business plan are twice as likely to

grow and secure investment capital as those that don't.

This may seem like an insurmountable task. But it doesn't need to be.

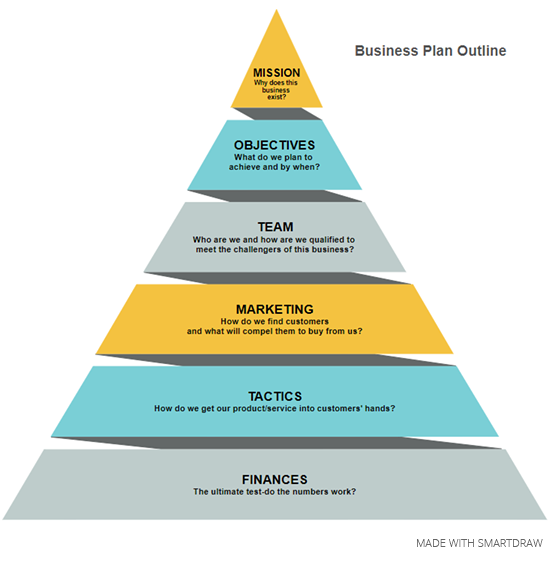

We've boiled the important elements down to a few diagrams. Complete these and

you'll have a great, visual business plan that will take a fraction of the time

to complete than a traditional narrative one. It will also be appreciated by readers,

who can see and understand the key elements of your plan quickly, without wasting a lot of time.

Too many businesses fail because the entrepreneur(s) weren't in business for the right reason. All too often, the drive is a desire to get rich or leave a job one doesn't like. Unfortunately, emotional motives usually doom a new enterprise.

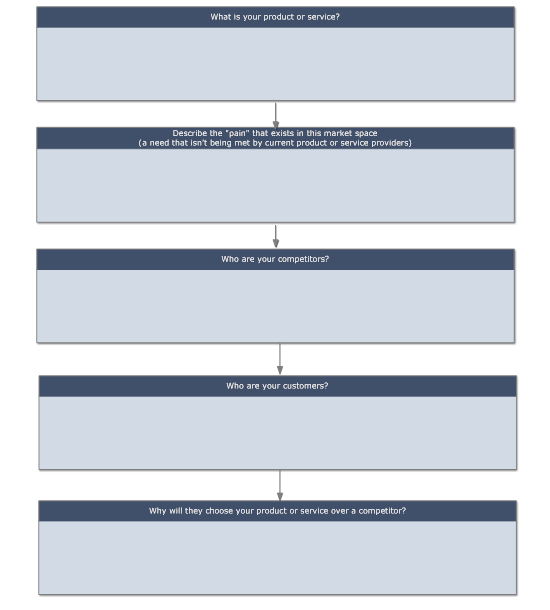

Focus on the "why" of your business—its purpose for existing. Richard Branson believes that a sense of frustration is the key to business success. His first venture, Virgin Records, was launched because he didn't like how a few high-priced London record outlets controlled the market. His company's mission was to ease this frustration by making it easier and cheaper for people to buy music.

A good way to summarize your mission is with a process list diagram. It has five key questions about what your business is, who your customers are, and why it will succeed within its market space. Each answer needs to be brief—no more than a couple of sentences. Keep your thinking very "high level" in this exercise.

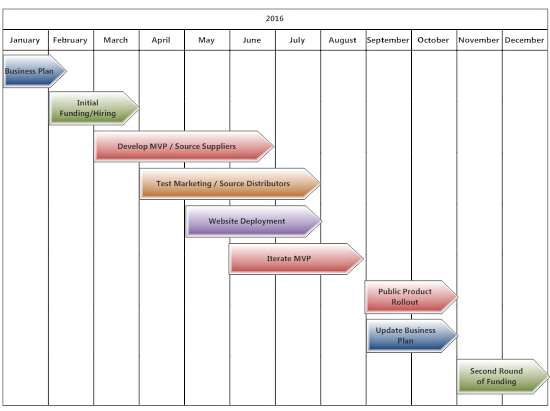

What are your primary objectives over a specific time period? How long a time period?

For most businesses, this timeframe should be long enough to get the business to at

least its first major milestone—profitability, an equity event, etc. It should

not be less than a year nor should it be longer than five years.

A timeline diagram is a good way to present this.

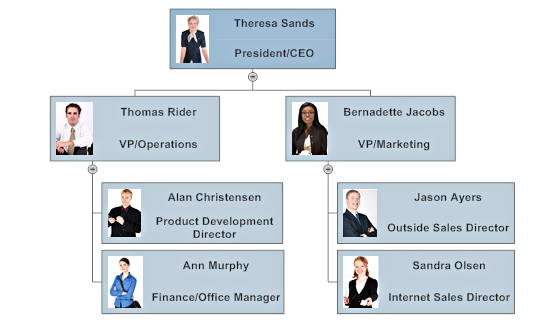

Lenders, angel investors, and venture capital firms want to know who comprises the team. Do your backgrounds, qualifications, and experiences fit the mission?

An organizational chart should be included, along with a brief bio of each key individual. Make it clear why each person is the right "fit" for the mission.

Getting your product into your customers' hands requires a clear and concise strategy. In today's world, having a well-thought-out marketing plan is essential.

A good starting place for this is a 4Ps diagram. It looks at your product, who the potential buyers are, how to reach them, and at what price point they will buy.

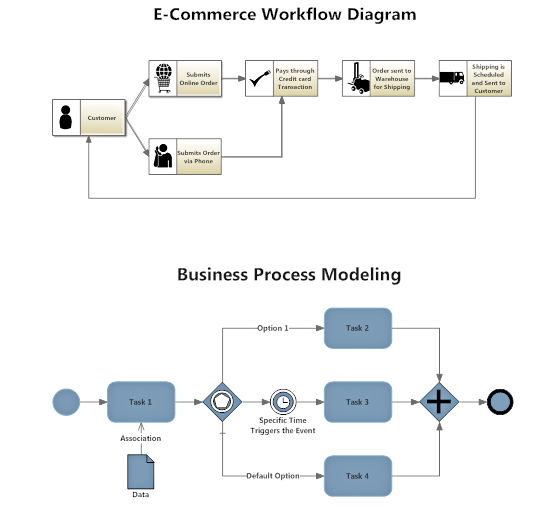

Here's where you want to show you can deliver on your promises. This means getting the product from concept to customers' hands within a timeframe that meets or exceeds their expectations.

There are a number of ways to present this. For most businesses, a basic flowchart, such as a workflow diagram or business process map will work well.

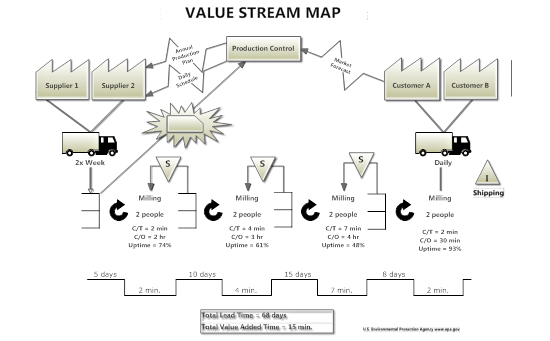

For manufacturing companies, a value stream map is an excellent tool. It not only explains a potentially complicated process succinctly, it also helps your management and production teams to evaluate and streamline operational efficiency.

What numbers should you present in your business plan? There are many possible answers to this question. It really depends on the purpose of your business plan and who will be receiving it.

For example, say you are writing a business plan for the internal purposes of management. You may not need to document historical data or validate projections to the degree you should, say, for a bank loan.

If you're seeking investment capital, then you need to make sure your forecasts are extremely well thought out, and they show the investor(s) a clear plan for how and when they will be compensated.

Regardless of your intended audience, there are a few financial documents you should include in your business plan.

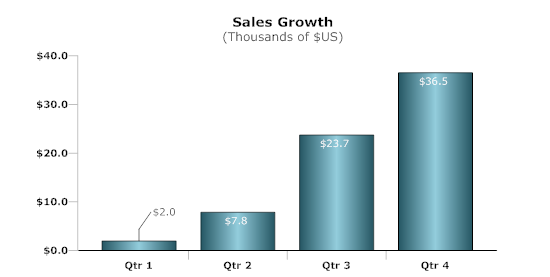

- Income statements, cash flow statements, and balance sheets should be included if the business has an operating history. You should show trends of sales, if available, using a line chart or bar chart.

For both existing businesses and startups, you will need a set of projections. Most investors and lenders want to see a forecast of three to five years. Realize that everyone knows it's impossible to accurately predict the future, particularly for a new company. What they are looking for is your thinking—that you have a clear plan for achieving these numbers and that they are based on facts and logic, not pipe dreams.

For both existing businesses and startups, you will need a set of projections. Most investors and lenders want to see a forecast of three to five years. Realize that everyone knows it's impossible to accurately predict the future, particularly for a new company. What they are looking for is your thinking—that you have a clear plan for achieving these numbers and that they are based on facts and logic, not pipe dreams.

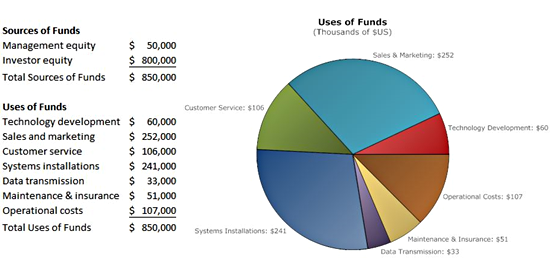

- A detailed budget for start-up costs and where the capital to fund them will come from. In accounting lingo, this is a "sources and uses of funds" statement. A pie chart may be useful for presenting the budget visually.

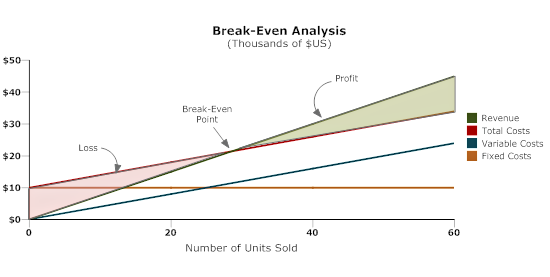

- A break-even analysis should be included, showing the point at which total revenues will cover expenses. This can be done with a line chart.

Most experts offer one often-overlooked word of advice about financial forecasts: contingency. Make sure that your models allow for unforeseen factors, because they will happen. This might include extra lead time in the process chain and some "rainy day" funds in the budget. Allowing for contingency is smart business planning.

Most experts offer one often-overlooked word of advice about financial forecasts: contingency. Make sure that your models allow for unforeseen factors, because they will happen. This might include extra lead time in the process chain and some "rainy day" funds in the budget. Allowing for contingency is smart business planning.