- Product

- Diagramming Build diagrams of all kinds from flowcharts to floor plans with intuitive tools and templates.

- Whiteboarding Collaborate with your team on a seamless workspace no matter where they are.

- Data Generate diagrams from data and add data to shapes to enhance your existing visuals.

- Enterprise Friendly Easy to administer and license your entire organization.

- Security See how we keep your data safe.

- Apps & Integrations Connect to all the tools you use from Microsoft, Google Workspace, Atlassian, and more.

- What's New Read about new features and updates.

- Solutions

- Product Management Roadmap features, brainstorm, and report on development, so your team can ship features that users love.

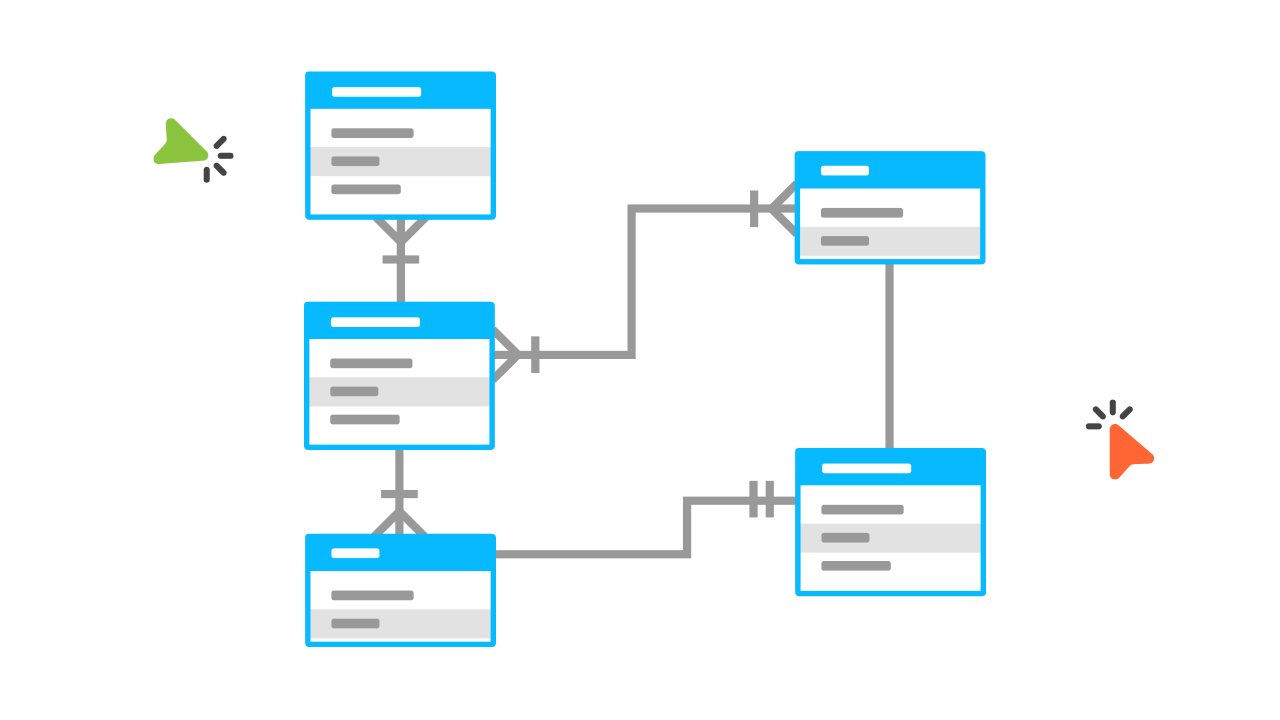

- Software Engineering Design and maintain complex systems collaboratively.

- Information Technology Visualize system architecture, document processes, and communicate internal policies.

- Sales Close bigger deals with reproducible processes that lead to successful onboarding and training.

- Resources

- Getting Started Learn how to make any type of visual with SmartDraw. Familiarize yourself with the UI, choosing templates, managing documents, and more.

- Templates get inspired by browsing examples and templates available in SmartDraw.

- Diagrams Learn about all the types of diagrams you can create with SmartDraw.

- Whiteboard Learn how to combine free-form brainstorming with diagram blueprints all while collaborating with your team.

- Data Visualizers Learn how to generate visuals like org charts and class diagrams from data.

- Development Platform Browse built-in data visualizers and see how you can build your own custom visualization.

- Open API The SmartDraw API allows you to skip the drawing process and generate diagrams from data automatically.

- Shape Data Add data to shapes, import data, export manifests, and create data rules to change dashboards that update.

- Explore SmartDraw Check out useful features that will make your life easier.

- Blog Read articles about best practices, find tips on collaborating, learn to give better presentations and more.

- Support Search through SmartDraw's knowledge base, view frequently asked questions, or contact our support team.

- Enterprise

- Pricing

- My Account

- Contact Sales

Product

-

Diagramming

Build diagrams of all kinds from flowcharts to floor plans with intuitive tools and templates. -

Whiteboarding

Collaborate with your team on a seamless workspace no matter where they are. -

Data

Generate diagrams from data and add data to shapes to enhance your existing visuals. -

Enterprise Friendly

Easy to administer and license your entire organization. -

Security

See how we keep your data safe. -

Apps & Integrations

Connect to all the tools you use from Microsoft, Google Workspace, Atlassian, and more.

Solutions By Team

-

Product Management

Roadmap features, brainstorm, and report on development, so your team can ship features that users love. -

Software Engineering

Design and maintain complex systems collaboratively. -

Information Technology

Visualize system architecture, document processes, and communicate internal policies. -

Sales

Close bigger deals with reproducible processes that lead to successful onboarding and training.

License Everyone For as Low as $5 per User per Month

Save money, and replace Visio, Lucidchart, Lucidspark, and Miro with a SmartDraw enterprise license.

Learn

-

Getting Started

Learn to make visuals, familiarize yourself with the UI, choosing templates, managing documents, and more. -

Templates

Get inspired by browsing examples and templates available in SmartDraw. -

Diagrams

Learn about all the types of diagrams you can create with SmartDraw. -

Whiteboard

Learn how to combine free-form brainstorming with diagram blueprints all while collaborating with your team. -

Data Visualizers

Learn how to generate visuals like org charts and class diagrams from data. -

Support

Search through SmartDraw's knowledge base, view frequently asked questions, or contact our support team.

Developer Resources

-

Development Platform

Browse built-in data visualizers and see how you can build your own custom visualization. -

Open API

The SmartDraw API allows you to skip the drawing process and generate diagrams from data automatically. -

Shape Data

Add data to shapes, import data, export manifests, and create data rules to change dashboards that update.